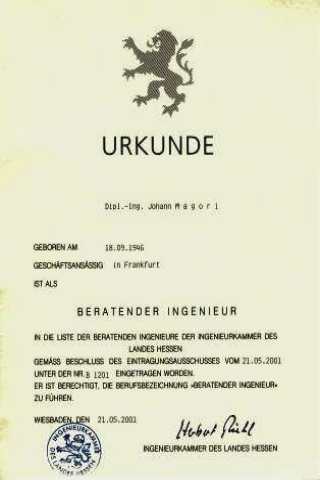

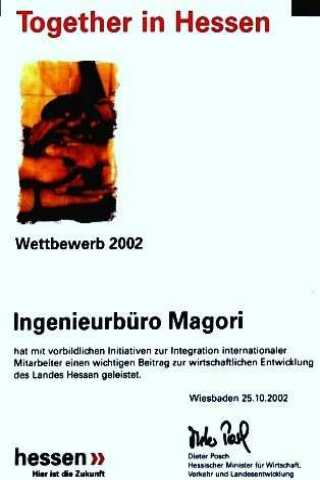

ENGINEERING

- MAGORI -

CONSULTING

– ROMANIA – BINE AŢI VENIT

BridgeLink AG – Partner –

– Activităţi principale – Acquisitions : Equity Link ™

Mergers and Acquisitions (M&A) :

Business Design ™ / Business Control ™

Die BridgeLink-Marken :

Equity Link ™ : Identifizierung von Investoren und Private Equity sowie die Beschaffung von entsprechenden finanziellen

Mittel (Wachstumskapital, Firmenkauf, strategische Partnerschaften, etc.)

Business Design ™ :

Massnahmen und Instrumente zur Prozessgestaltung im laufenden Betrieb, zur Vorbereitung auf einen Firmenkauf/-verkauf

oder zur Nachfolgeregelung.

Business Control ™ :

Instrumente zur Überwachung und Steuerung des betreuten Unternehmens (Financial Controlling, Marketing, Organisation).

Mergers and Acquisitions (M&A) :

( M&A – Geschäft, deutsch:

Fusionen und Übernahmen ) (rumänisch:

Fuziune & Achiziţii –

F & A )

ist ein Sammelbegriff für Unternehmenstransaktionen, bei denen sich Gesellschaften zusammenschließen oder den Eigentümer wechseln.

In der Regel vollzieht sich eine entsprechende Übernahme im Wege des Unternehmenskaufs.

(M&A)

bezeichnet den Vorgang an sich als auch die Branche der hiermit befassten Dienstleister wie Investmentbanken, Wirtschaftsjuristen, Wirtschaftsprüfer und Berater.

In der Branche der Investmentbanken gilt M&A als Teilbereich der Corporate Finance.

« Succesiunea intreprinderii – Procedee si Finanţare »

Author: © Peter H. Altherr – lic. rer. pol.– studierte Jurisprudenz,

Betriebs- und Volkswirtschaft an der Universität Basel. –

Es kann nicht hingenommen werden, dass Tausende gesunder Unternehmen und guter Arbeitsplätze nur deshalb verloren gehen,

weil die Übertragung eines Unternehmens zu mühselig ist.

Mit unserer heute vorgestellten Initiative wollen wir hier Abhilfe schaffen.

Wir wollen eine Verbesserung des wirtschaftlichen Umfelds und

der Maßnahmen zur Unterstützung von Unternehmensübertragungen bewirken.

" Günter Verheugen – Vizepräsident der

Europäischen Kommision "

KfW - Kreditanstalt für Wiederaufbau :

( Als Bank des Bundes und der Länder ist die KfW Förderbank der deutschen Wirtschaft

und Entwicklungsbank für die Transformations- und Entwicklungsländer. )

" – Die Zahl der Fälle, in denen eine Nachfolgeregelung bei kleinen und mittleren Unternehmen ansteht,

wird nach den Erkenntnissen der KfW in Deutschland

auch in Zukunft mit etwa 71 000 Fällen pro Jahr auf einem höhen Niveau bleiben. – "

1. Elaborarea la timp a premiselor.

1. Elaborarea la timp a premiselor.

– Un număr mare de intreprinderi mici şi mijlocii se află astâzi in faţa unui iminent schimb de generaţii.

Totuşi proprietarii unor astfel de firme îşi fac planuri mult prea tîrziu in ce priviste succesiunea.

Acest subiect succesiunea este tratat cu indiferenţa şi subestimat în ceea ce priveste necesarul de timp.

Daca vînzatorul preia personal procesul de vînzare, acest lucru inseamnă, că pe lînga

solicitare emoţionale şi de timp, pot apărea erori critice,

nu se epuizează toate soluţionâri creative posibile.

– Toate soluţionările posibile sunt prea puţin utile, dacâ întreprinderea nu este pregatită pentru vînzare.

Un portofoliu imobiliar bun, rezerve mari bilanţier sau depozite cash ridicate nu fac neapărat ca firma sa fie mai valoroasă.

Dimpotriva, chiar plecând de la aceste premise sunt necesare măsuri şi timp, pentru a face firma vândabilă şi pentru a evita eventuale piedici şi pierderi de împozit.

2. Alternative la succesiunea in familie.

2. Alternative la succesiunea in familie.

– Dacă o întreprindere nu găseste o soluţie în cadrul familiei, atunci următoarele opţiune garantează asigurarea viitorului:

-

Management Buyout

(MBO)

[2] :

Managementul întreprinderii, preia firma.

MBO-ul a dovedit in multe cazuri că este o soluţie bună şi logică.

Intreprinzătorul în astfel de situaţii este de accord şi acceptă anumite concesii legate de preţ şi condiţiile generale.

-

Management Buyin (MBI)

[3] :

o persoana externă sau un grup devine proprietarul întreprinderii şi membru al echipei de Management.

-

Trade Sale (vînzarea catre investitori strategici)

[4]

în acest caz poate fi vorba de un concurent, sau de o firmă asezată inainte sau după,

în lanţul de creare a valorilor noi, dintr-un domeniu asemănător. Pentru firma care se va vinde se deschid noi orizonturi care-i permit datorită întăririi financiare, să se dezvolte repede şi eficient.

-

Initial Public Stock Offering / (De)Börsengang /.

(IPO)

[5] :

In funcţie de situaţia economică şi marimea întreprinderii, poate deveni IPO o soluţie alternativa,

deşi doar anumite întreprinderi sunt potrivite pentru astfel de soluţii costisitoare şi mari consumatoare de timp.

3. « PRIVATE EQUITY » instrument financiar.

3. « PRIVATE EQUITY » instrument financiar.

De multe ori vânzatorul pleacă de la idea, ca Management-ul (MBO) sau persoanele externe (MBI)

nu dispun de suficiente mijloace financiare pentru cumpărare.

In mod mental ei exclud metoda MBO

[2] sau

MBI

[3] .

In cazul unui Trade Sale [4]

intervin rareori, îndoieli, privind finanţarea preţului de cumpărare.

Pe nedrept, deoarece, de multe ori, Intreprinzătorul, necesită mijloace financiare suplimentare atunci când vrea sa achiziţioneze o firmă.

Pentru procurarea de mijloace financiare primul drum al potenţialului cumpărător este către banca.

In cazul în care există o relaţie de lungă durata cu banca, atunci se poate efectua cumpărarea întreprinderii prin intermediul creditelor bancare.

Finanţarea cumpărărilor de întreprinderi este privită din punctul de vedere al băncilor ca un capital de risc.

Tocmai din acest motiv instituţiile bancare sunt reţinute faţa astfel de finanţări.

Finanţarea bancară clasică nu mai este astăzi un lucru imposibil. Dar de cele mai multe ori se realizează sub premisele că, cumpărătorul contribuie cu o cotă proprie suficientă.

Mai putin cunoscut este termenul de

"Private Equity" [6].

Aici este vorba de capitalul de risc (capital propriu)pe care investitorul il aduce.Cu mijloacele proprii el işi întâreste baza capitalului propriu şi işi creaza în acest fel premisele unei finanţări externe complementare.

Principalele premise pentru găsirea unui partener

"

Private Equity-Partners" [

6]

sunt:

- Un plan de afaceri clar,

- evolutia pozitivă a întreprinderii şi ,

- echipa Managerială bună, competentă.

Criteriile de investiţii, cota de contribuţie şi alte condiţii ale firmelor

"Private Equity" [6]

sunt foarte diferite şi trebuiesc analizate in detaliu, particular, de la caz la caz.

4. Exemplu de finanţare.

4. Exemplu de finanţare.

In exemplul nostru pornim de la idea ca, succesiunea intreprinderii X se va face prin metoda Management Buyout (MBO)

[2].

– Pretul de vânzare este de 8 milioane €.

– Management-ul intreprinderii are la dispoziţie o sumă de 2 milioane €.

Aceasta situaţia iniţiala, prezintă mijloace insuficiente, şi lasă de dorit, şi nu este multumitori.

Prin atragerea unei capital extern din partea

Private Equity [6]

ar rezulta următoarea structură, formă de finanţare:

– mijloace proprii în sumă de 2,0 milioane € din partea echipei de Management,

– 2,5 Milioane € capital suplimentar în acţiuni de la partenerii

"Private Equity"– şi

– 3,5 Milioane € capital strain de la bancă.

Astfel preţul de cumpărare este

finanţat şi succesiunea soluţionată, desigur in acest exemplu echipa de Management ar deţine capital minoritar.

Teama cumpăratorului de a pierde influenţa în propria intreprindere printr-o participare minoritară este de înteles,

dar nejustificata.

Partenerii "

Private Equity" -sunt PARTNER, insoţitori profesionisti, al cumpăratorului, noului proprietar.

Nu se amestecă în ordniea de zi a firmei, dar sprijină proprietarii şi echipa de Management în procesul

de dezvoltare /extindere a firmei (deschiderea noi pieţe, achiziţionarea de firme) să realizeze.

5. Consecventa.

5. Consecventa.

Succesiunea in intreprindere cu finanţarea aferentă necesită destul timp şi de aceea trebuie abordată in timp util.

Alternativele posibile ar trebui evaluate de către experţi in domeniu .

Astfel i se acorda vânzătorului sansă de a alege o solutie individuală.

Dacă cumpărătorul poate să cotizeze numai cu o parte din preţul de cumpărare, in condiţii prestabilite, partenerul

"Private Equity"-Partner

îl poate sprijini şi dacă este cazul îi poate acorda o finanţare complementară pentru cumpărare.

Exista multe metode de a realiza obiectivul propus, chiar şi succesiunea in intreprinderea dumneavoastră!

"

Peter H. Altherr – Partner – "

" doing the right thing – instead of –

doing things right. "

Why will the wheel be stell invented every day? – Do not Reinvent the Wheel –

– Siehe auch:

- EU - KMU Förderung : - Kommission will Übertragung von Unternehmen unterstützen.

– Siehe auch:

- KfW - Fördermittel - zur Finanzierung von Unternehmensnachfolgen.

– Vezi: Articolul Original in limba germana.

– "Nachfolge im Unternehmen – Wege und Finanzierung" –

4. Glossary of Terms. Dokumentation - Bibliography

4. Glossary of Terms. Dokumentation - Bibliography

|

« Terms. Dokumentation - Bibliography » |

LINKS |

[1]Business plan

[1]Business plan

A business plan is a formal statement of a set of business goals, the reasons why they are believed attainable,

and the plan for reaching those goals.

Business plans are decision-making tools.

The content and format of the business plan is determined by the goals and audience.

A business plan should contain whatever information is needed to decide whether or not to pursue a goal.

– Banks are quite concerned about defaults, so a business plan for a

bank loan will build a convincing case for the organization’s ability to repay the loan.

– Venture capitalists are primarily concerned about initial investment, feasibility, and exit valuation.

– A business plan for a project requiring equity financing will need to explain why current resources,

upcoming growth opportunities, and sustainable competitive advantage will lead to a high exit valuation.

"... a good business plan can help to make a good business credible, understandable, and attractive to someone who is

unfamiliar with the business.

Writing a good business plan can’t guarantee success, but it can go a long way toward reducing the odds of failure."

Eric S. Siegel, Brian R. Ford, Jay M. Bornstein (1993),

'The Ernst & Young Business Plan Guide'

(New York: John Wiley and Sons)

ISBN 0471578266

Preparing a business plan draws on a wide range of knowledge from many different business disciplines :

• finance,

• human resource management,

• intellectual property management,

• supply chain management,

• operations management, and

• marketing, among others.

Some of these content areas may be more or less important depending on the kind of business plan.

There is no fixed content for a business plan.

Rather the content and format of the business plan is determined by the goals and audience.

Once a business plan has been developed, the key decision making points are usually summarized in an executive summary.

Content of a business plan (generally):

– 1. Executive Summary

– 2. Organizational Background

– 3. Marketing Plan

– 4. Operational Plan

– 5. Financial Plan

– 6. Risk analysis

– 7. Decision Making Criteria

The specific content will be highly dependent on the core purpose and target audience.

|

|

|

|

[3]Management buy-in (MBI)

[3]Management buy-in (MBI)

A management buyin (MBI) occurs when a manager or a management team from outside the company raises the necessary finance, buys it, and becomes the company's new management.

|

|

|

|

[5]IPO (initial public stock offering )

[5]IPO (initial public stock offering )

An initial public stock offering (IPO) referred to simply as an "offering" or "flotation,"

is when a company issues common stock or shares to the public for the first time. They are often issued by smaller,

younger companies seeking capital to expand, but can also be done by large privately-owned companies looking to become publicly traded

|

|

[6]Private equity

[6]Private equity

In finance, private equity is an asset class consisting of equity securities in operating companies that are not publicly traded on a stock exchange.

Investments in private equity most often involve either an investment of capital into an operating company or the acquisition of an operating company.

|

|

[7]Spin-off

( Corporate spin-off – Spin out )

[7]Spin-off

( Corporate spin-off – Spin out )

Spin out refers to a type of spin off where a company "splits off" sections of itself as a separate business.

The common definition of spin out is a division of a company or organization that becomes an independent business.

The "spin out" company takes assets, intellectual property, technology, and/or existing products from the parent organization.

|

|

[8]Venture capital

( Private Equity; Venture Capital; )

[8]Venture capital

( Private Equity; Venture Capital; )

Venture capital (also known as VC or Venture) is a type of private equity capital typically provided to early-stage, high-potential,

growth companies in the interest of generating a return through an eventual realization event such as an IPO or trade sale of the company.

Venture capital investments are generally made as cash in exchange for shares in the invested company.

|

|

|

|

[10]Due Diligence

[10]Due Diligence

Due Diligence is a term used for a number of concepts involving either the performance of an investigation

of a business or person, or the performance of an act with a certain standard of care.

It can be a legal obligation, but the term will more commonly apply to voluntary investigations.

In business transactions, the due diligence process varies for different types of companies.

Due diligence in business transactions.

The relevant areas of concern may include the financial, legal, labor, tax, IT,

environment and market/commercial situation of the company.

Other areas include intellectual property, real and personal property, insurance and liability coverage,

debt instrument review, employee benefits and labor matters, immigration, and international transactions.

Gary M. Lawrence,

Due Diligence in Business Transactions.

(

Law Journal Press 1994.

)

ISBN 9781588520661

|

|

[11]Finanzsystem

[11]Finanzsystem

Brandbeschleuniger im Finanzsystem.

von Martin Hellwig

Prof. Dr. Martin Hellwig ist seit 2004 Direktor am Max-Planck-Institut zur Erforschung von Gemeinschaftsgütern in Bonn.

Seine Laufbahn führte ihn unter anderem an die Universitäten Stanford, Princeton, Harvard und Basel.

Hellwig beschäftigt sich mit Informationsökonomik, öffentlichen Gütern und Steuern sowie mit Finanzmärkten und -institutionen.

Er ist Vorsitzender des Lenkungsrats des Wirtschaftsfonds Deutschland.

Copyright © 2009, Max-Planck-Gesellschaft, München.

|

|

Inapoi la titlul articolului.

Inapoi la titlul articolului.

ENGINEERING

- MAGORI -

CONSULTING